One Small Mistake in Your ITR Can Cost You Your Entire Refund

Avoid Penalties, Claim Refunds- Your Hassle free ITR Filing Starts Here.

No Hassle, No Confusion Our trusted experts file your return accurately & on time

10+

YEARS OF EXPERIENCE

500+

CLIENTS SERVED

Choose A Package That Fits Your needs

BASIC

₹999/year

*Exclusive of Taxes

- Income from Salary

- Income from One House Property

- Income from Other Sources

ADVANCED

₹1499/year

*Exclusive of Taxes

- Income from Salary

- Income from More than One House Property

- Income from Other Sources

- Agriculture Income

PLATINUM

₹1999/year

*Exclusive of Taxes

- Income from Salary

- Income from More than One House Property

- Income from Other Sources

- Income from Capital Gain (Stock Market, Sale of Land/Building)

- Agriculture Income

Our Main Services

ITR Filing

Expert-led ITR filing for individuals and businesses. Maximize savings, ensure compliance, and avoid penalties with our accurate, timely, and hassle-free tax filing support.

Company Registration

Start your business legally with complete company registration support. From name approval to final certificate, we handle everything with clarity and zero confusion.

GST Registration Services

Get GST registered quickly and correctly. We handle the paperwork, guide you through the process, and ensure you stay compliant with updated tax regulations.

Accounting & Book-Keeping

Stay financially organized and audit-ready. Our expert bookkeeping ensures accurate records, real-time insights, and stress-free compliance—so you can focus on business growth

FSSAI Registration

Get FSSAI license quickly for your food business. Ensure safety comp-liance and build customer trust with our expert help.

ROC Compliances

Stay financially organized and audit-ready. Our expert bookkeeping ensures accurate records, real-time insights, and stress-free compliance—so you can focus on business growth

What are our clients saying

about our Services

I am very happy with the services provided. They are professional, responsive, and thorough, making the process smooth and stress-free. I highly recommend them for reliable accounting and financial services!

-Rahul

Excellent service with excellent staff, Especially thanks to Vaishaka mam & Sumit Sir.

-Sachin Bhatia

Service was exceptional. They not only provided accurate and timely advice but also explained complex tax laws in a clear and understandable manner. Their professionalism and dedication were evident throughout the process. I highly recommend their services.

-Lakhwinder Singh

Why Choose us?

For over 10 years, we’ve been helping individuals, startups, and businesses stay compliant, reduce tax liability, and grow confidently.

- Experienced & Certified Professionals – Handled 1000+ clients across various industries

- On-Time Compliance Guarantee – Never miss a deadline with our proactive alerts

- 100% Confidentiality & Data Security – Your financial data is safe with us

- Personalized Support – Get one-on-one guidance for your specific tax and business needs

- Complete CA Solutions Under One Roof – ITR filing, GST, company registration, audits & more

- Business-Focused Advice – Not just compliance, we help you grow and save smarter

- Transparent & Affordable Pricing – No hidden fees, only value-driven services

- Hassle-Free Process – Upload your documents, we’ll handle the rest

- Digital Convenience – Work with us from anywhere in India via secure online platforms

- Trusted by Individuals, Startups & SMEs – 5-star feedback from satisfied clients

Claim Your FREE 15-Minute Tax Consultation

Only 5 Free Consultations Left This Week!

Book now to secure your spot. Offer may expire soon.

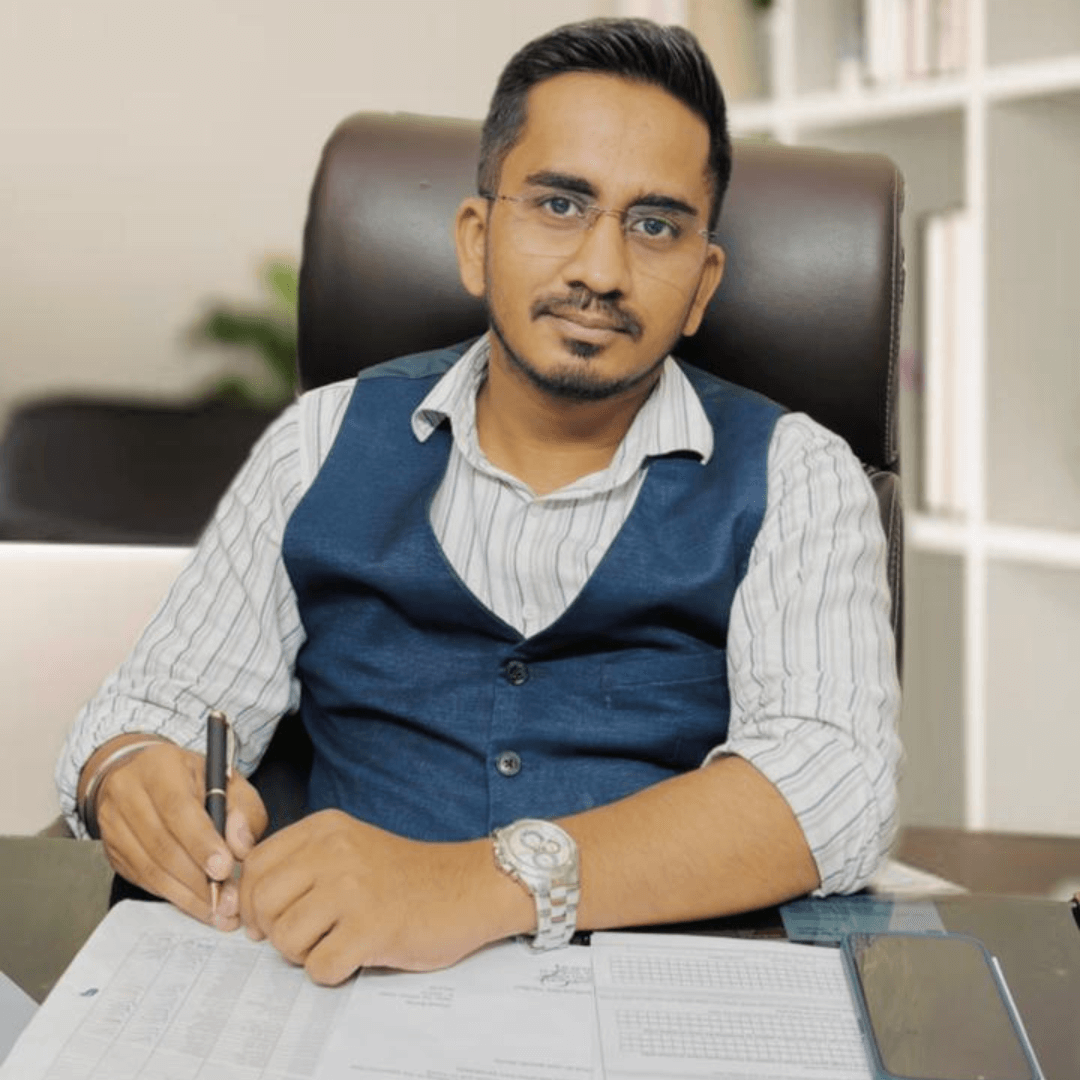

Our Best Team

Mr. Rohit Singh

Founder & Director

Direct Tax Matters, Indirect Tax Matters Corporate Compliances, Litigation & Representation in Departmental Matters

Ms. Vishakha

Founder and Director

Business/Startup Registrations, MCA compliances, Business Development

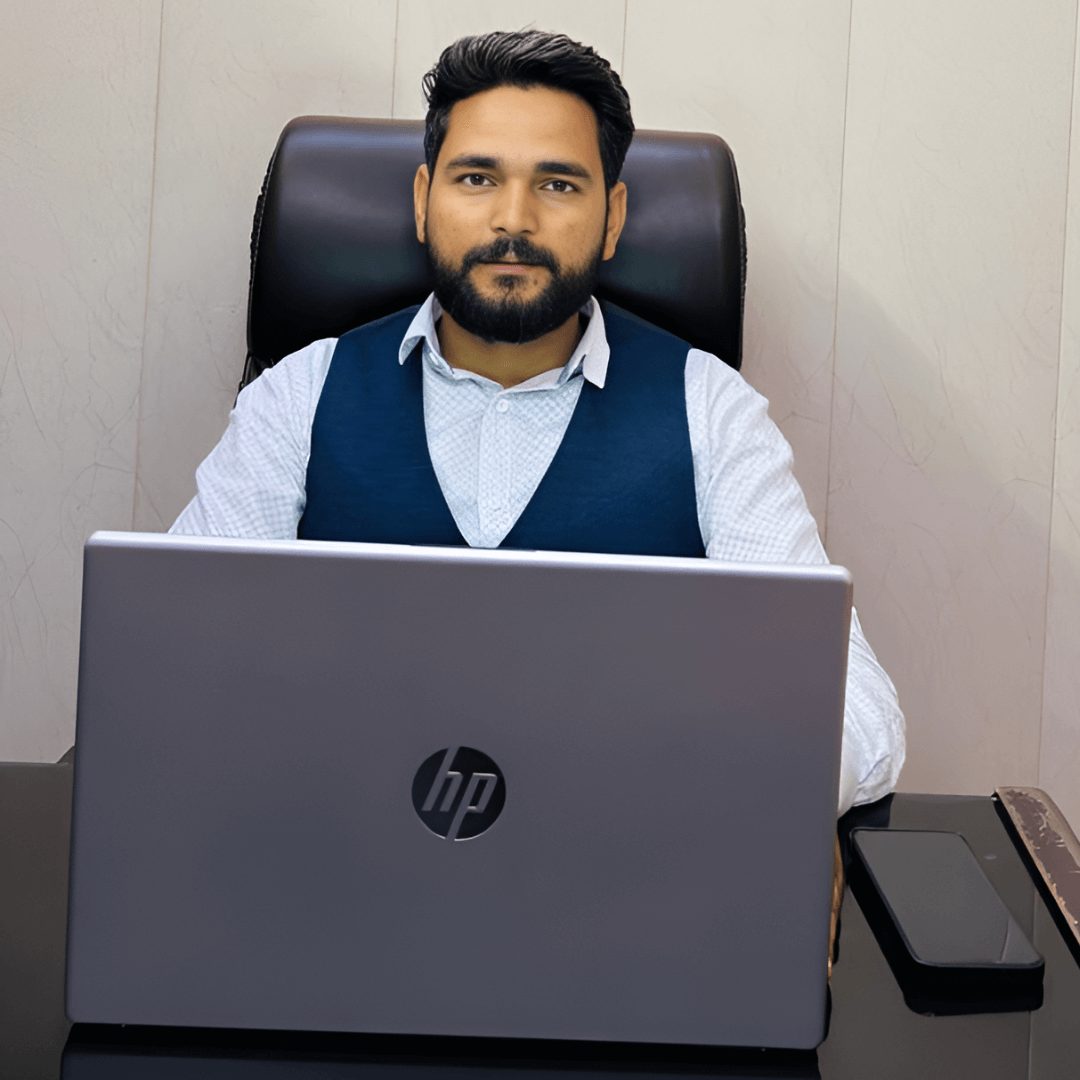

Mr. Sumit Yadav

Chief Operational Officer

Direct Tax Matters, Indirect Tax Matters, Financial Compliance Expert

Our Best Team

Ms. Vishakha

Founder and Director

Business/Startup Registrations, MCA compliances, Business Development

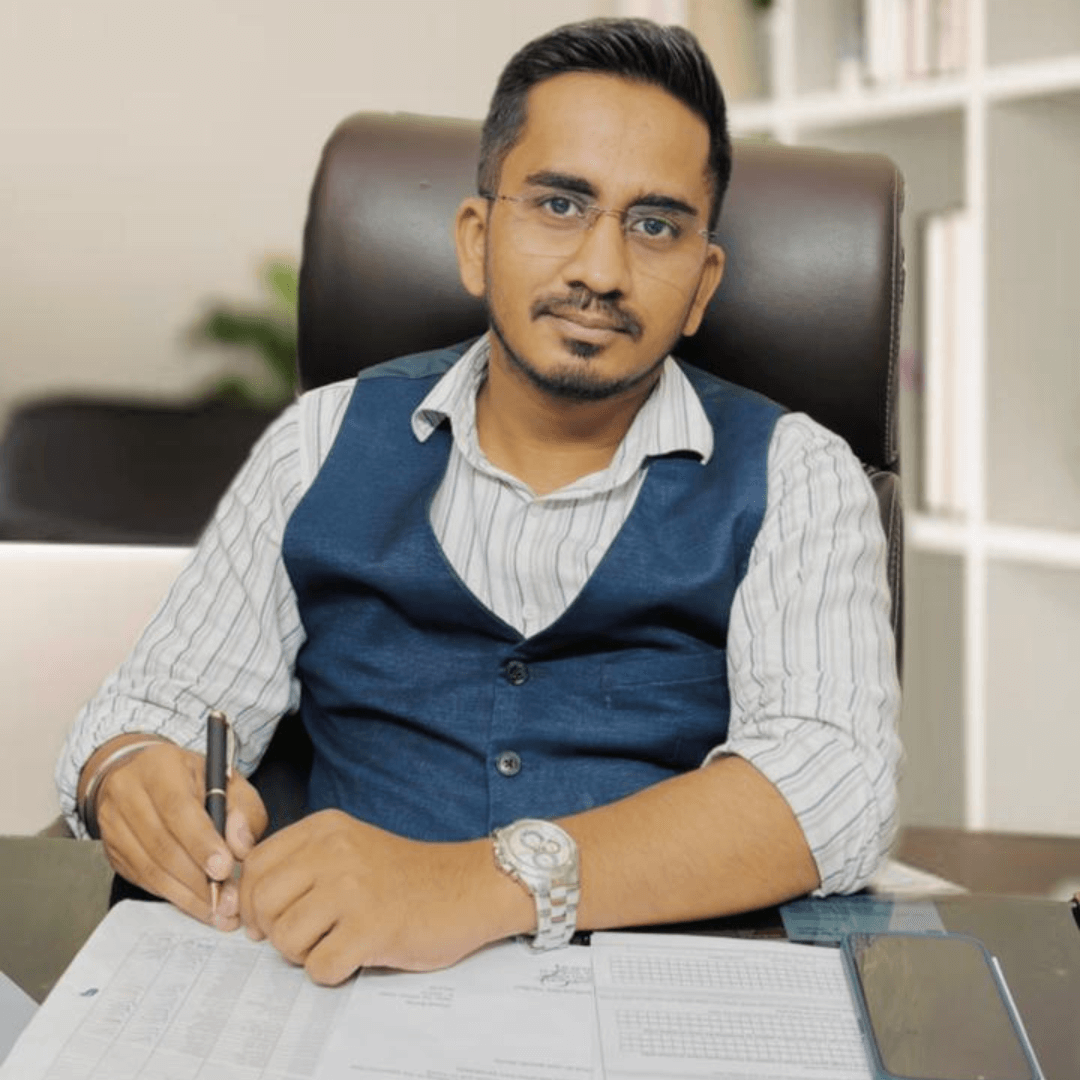

Mr. Rohit Singh

Founder & Director

Direct Tax Matters, Indirect Tax Matters Corporate Compliances, Litigation & Representation in Departmental Matters

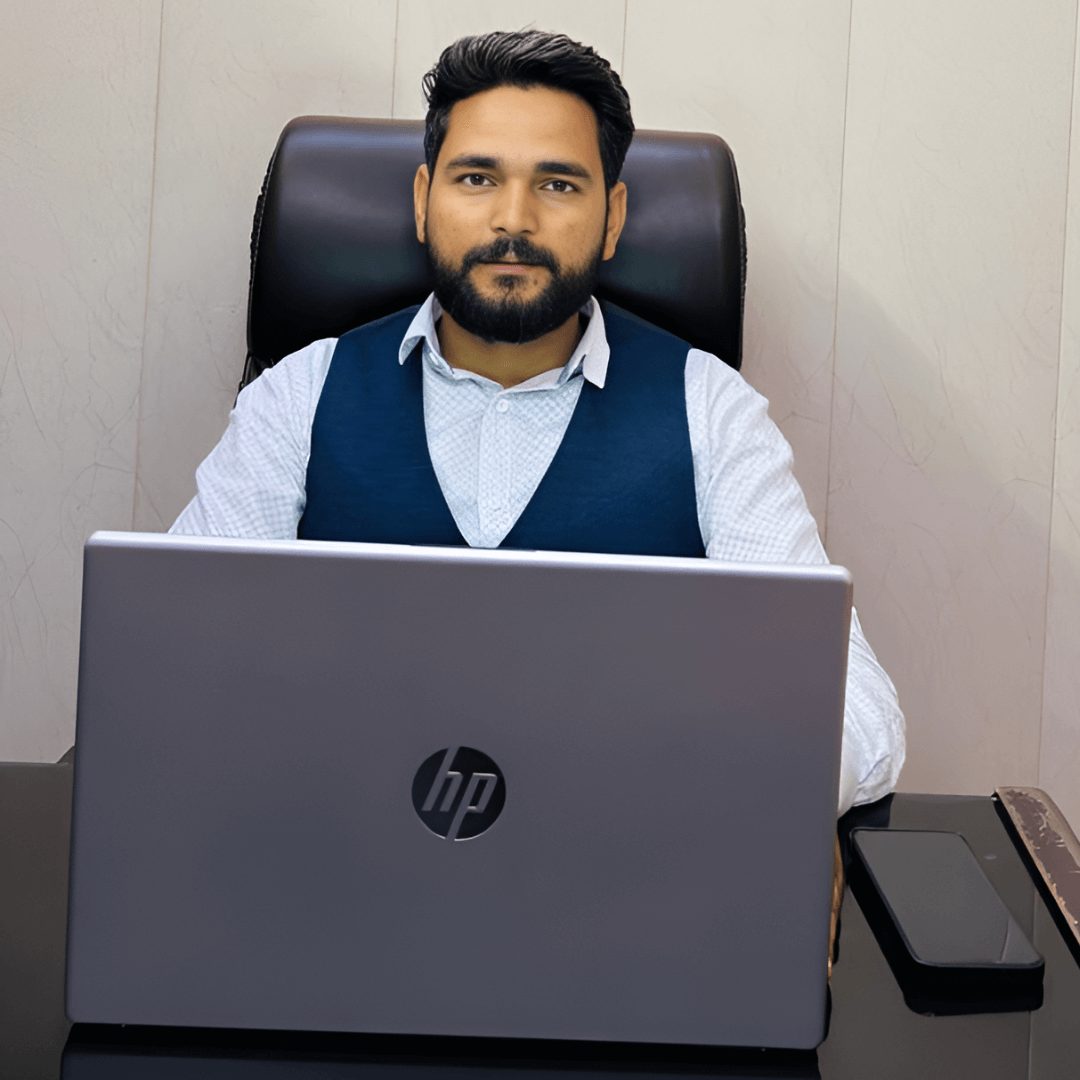

Mr. Sumit Yadav

Chief Operational Officer

Direct Tax Matters, Indirect Tax Matters, Financial Compliance Expert

Frequently Asked Questions

Do I need to file an ITR even if my income is below the taxable limit?

Yes, in some cases, filing is mandatory even if your income is below ₹2.5 lakh (basic exemption limit), such as:

1. If TDS has been deducted and refund is to be claimed.

2. If you have foreign assets or income.

3. If you deposited over ₹1 crore in a bank account.

4. If your electricity bill exceeded ₹1 lakh in a year.

What happens if I miss the deadline?

A late fee up to ₹5,000 may apply. Refunds may be delayed, and you may lose the option to carry forward losses.

Can I claim a refund of TDS deducted?

Yes. If excess TDS is deducted, the refund can be claimed while filing the ITR.

What are the due dates for filing ITR?

1. For individuals (not under audit): July 31

2. For audited accounts: October 31

3. Belated return: December 31

I have income from stocks or mutual funds. How should I report it?

You need to report capital gains (short-term or long-term) with supporting documents like broker statements, contract notes, etc.

Are my documents safe with you?

Absolutely. We follow strict data privacy and confidentiality standards.

Contact Us

- Phone

+91- 9211560980, 8285558644, 9716847407

- Email

taxwizersconsultant@gmail.com

- Website

www.taxwizersconsultant.com

- Address

90, Gali No. 1, Radhey Puri Extension, Shalimar Garden, Delhi, 110051

Our Best Services

- ITR Filing

- Company Registration

- GST Filling Services

- Accounting & Book-Keeping

- FSSAI Registration

- ROC Compliances

- Preparation of Financial statements

- Startup India Registration

Disclaimer: This website is privately operated and not affiliated with any government entity. We do not represent or are affiliated with, endorsed by, or in any way connected to any government body or department. The form provided is not for official registration purposes; rather, it's designed to gather information from our clients to help us better understand their business or needs. By continuing to use this website, you acknowledge that we are a private company. We offer assistance based on customer requests, and the fees collected on this website are for consultancy services. We reserve the right to outsource cases/matters as deemed necessary. We are in the process of giving our brand a new name. Stay tuned for updates